Global passenger EV (BEV+PHEV) sales grew 18% YoY in Q1 2024, according to Counterpoint’s EV Market Tracker. While BEV sales increased by 7% YoY during the quarter, PHEV sales grew 46% YoY.

China remained the global leader in Q1, followed by the US and Europe. China’s EV sales grew 28% YoY, while the US recorded a modest 2% YoY growth.

Overall EV sales in the US grew, but BEV sales declined by 3% YoY.

Leading EV players like Tesla and BYD have managed to reduce their BEV manufacturing costs, allowing them to offer competitive prices.

This has put pressure on other automakers like Ford and GM which are struggling to reduce their manufacturing costs.

These companies have introduced BEVs at competitive prices but are facing significant losses.

To mitigate these losses, traditional automakers are adjusting their BEV targets and prioritizing PHEVs.

The increased adoption of PHEVs is expected to continue until these automakers develop strategies to reduce BEV manufacturing costs and meet emission targets to avoid fines.

PHEVs are available in different body types, like sedans, SUVs, and crossover. Buying mid-priced PHEVs is a more logical choice for consumers since their prices are comparable to or lower than most of BEVs. In this category, PHEVs with the SUV body type are more in demand.

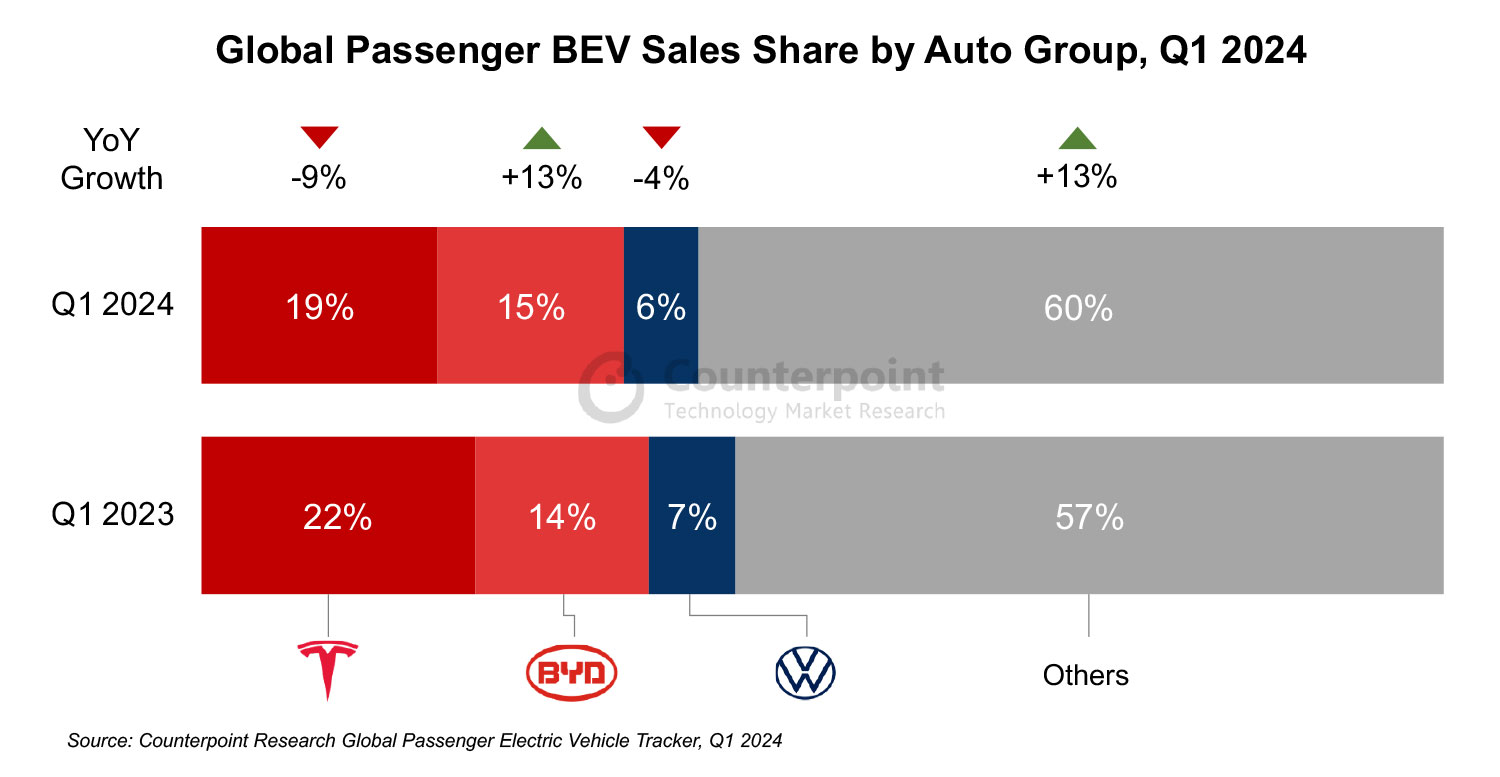

Despite a 9% YoY decline, Tesla regained the top position in BEV sales in Q1 2024, commanding a 19% market share.

Following closely behind were the BYD Group and Volkswagen Group. Notably, among the top three OEMs, only BYD achieved growth (13% YoY), while both Tesla and Volkswagen experienced declines of 9% and 4% YoY, respectively.

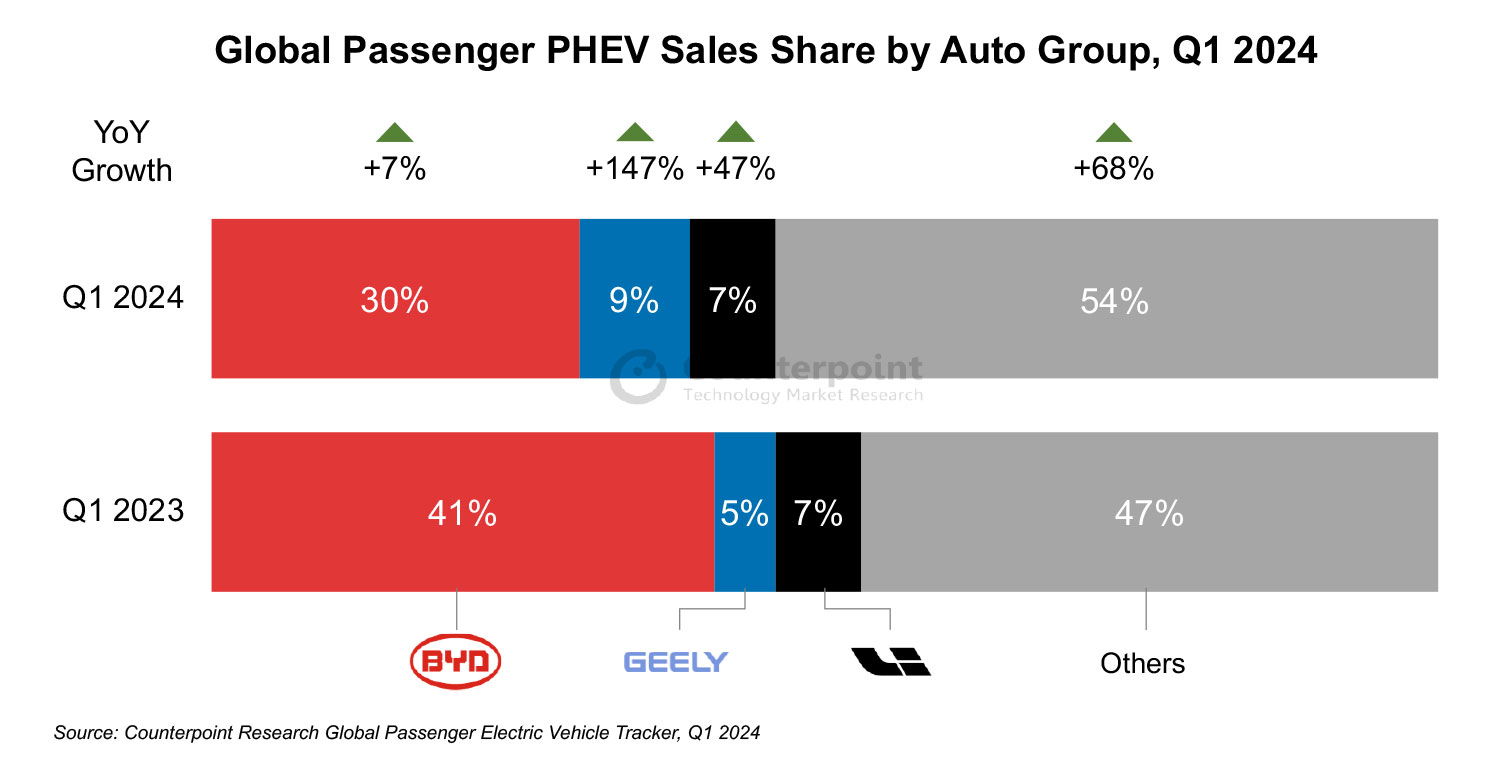

BYD also excelled in the PHEV segment, accounting for nearly one-third of global PHEV sales, followed by Geely Holdings and Li Auto. BYD exported almost 100,000 EVs, including PHEVs, with a substantial 152% YoY growth, primarily in the SEA region.

BYD’s export performance, especially in the SEA region, highlights the growing global demand for EVs, including PHEVs.

However, Tesla, which has only BEV fleets, currently faces challenges such as production delays and weakened early-adopter demand, which initially boosted its sales in advanced markets.”

Abonnieren fuer regelmaessige Marktupdates.

Bleiben Sie auf dem neuesten Stand der Branchentrends, indem Sie unseren Newsletter abonnieren. Unser Newsletter ist Ihr Zugang zu erstklassiger Marktexpertise.

ChangXin Memory Technologies (CXMT), China's top DRAM supplier, is reportedly preparing to phase out DDR4 products for server and PC use by mid-2026. As the company pivots to DDR5 and high-bandwid

Japan's push to revive its semiconductor manufacturing is hitting speed bumps as major manufacturers expressed cautiousness over operation or expansion amid weak demand outside of AI.According to

The global semiconductor manufacturing industry entered 2025 with typical seasonal patterns. However, looming tariff threats and evolving supply chain strategies are expected to create atypical season

At the TSMC Technology Symposium 2025 on May 15 in Hsinchu, Taiwan, T.S. Chang, VP of Advanced Technology and Mask Engineering at TSMC, announced the company's accelerated fab expansion plans. Pre

Chinese listed semiconductor equipment and materials companies released their 2024 annual financial reports in late April, revealing strong revenue growth but a decline in overall profitability. Despi

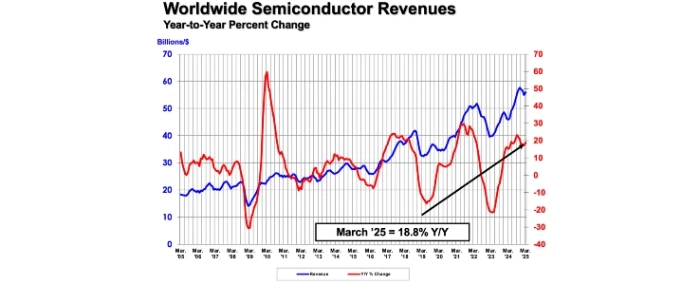

The Semiconductor Industry Association (SIA) reports that global semiconductor sales reached USD 167.7 billion in the first quarter of 2025, marking an 18.8% increase compared to the same period last