Latest research from IDC, titled Worldwide Semiconductor Integrated Device Manufacturing Market: Top 10 Vendor Ranking and Insight, 1Q24, reveals significant trends in the semiconductor industry during the first quarter of 2024. The report highlights the normalization of memory applications and inventory levels, driven by a stabilizing device market and the demand for AI training and inference in data centers. This recovery follows the fading of the COVID-19 pandemic. This normalization propelled the development of the integrated device manufacturing (IDM) market in the first quarter of 2024 (1Q24), where high-bandwidth memory (HBM) played a pivotal role.

The growing demand of HBM, priced four to five times higher than traditional memory, squeezed the capacity of DRAM in the device market and pushed up its price, significantly boosting the overall memory market revenue. Meanwhile, newly released AI PCs and AI smartphones required more memory content than traditional devices, which also drove the development of the memory market. Three of the top five IDM vendors for this quarter were memory-related, capturing nearly half of the top 10 vendors' revenue.

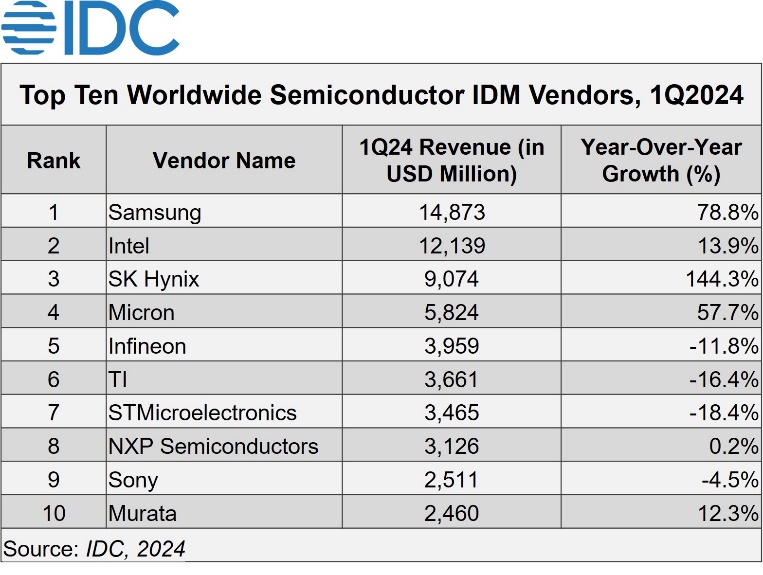

The top 10 vendors were Samsung, Intel, SK Hynix, Micron, Infineon, Texas Instruments, STMicroelectronics, NXP, Sony, and Murata. With the rising demand for AI in datacenters and the device market, memory is projected to remain an important driver for the development of the IDM in the second half of 2024 (2H24):

Computing remained the leading IDM application field in 1Q24, accounting for 35% of the total share, up from 29% in the same period last year. It was followed by the wireless communication market. The automotive market showed signs of sluggishness under the weight of mounting chip inventories, while the industrial market focused on de-inventory as customers double-ordered and stockpiled goods in response to the supply chain disruptions in the previous year. As a result, these two markets saw a sharp drop in their share compared to the same period last year. They are forecast to prioritize inventory adjustment in 1H24 and witness a rebound in the third quarter.

"In 2024, memory makers will continue to be key players in the global IDM market. As inventory levels gradually normalize, the demand in the automotive and industrial fields is projected to rebound in the second half of the year, which will contribute to the growth of the IDM market," said Helen Chiang, Head of Semiconductor Research, IDC Asia/Pacific.

Abonnieren fuer regelmaessige Marktupdates.

Bleiben Sie auf dem neuesten Stand der Branchentrends, indem Sie unseren Newsletter abonnieren. Unser Newsletter ist Ihr Zugang zu erstklassiger Marktexpertise.

ChangXin Memory Technologies (CXMT), China's top DRAM supplier, is reportedly preparing to phase out DDR4 products for server and PC use by mid-2026. As the company pivots to DDR5 and high-bandwid

Japan's push to revive its semiconductor manufacturing is hitting speed bumps as major manufacturers expressed cautiousness over operation or expansion amid weak demand outside of AI.According to

The global semiconductor manufacturing industry entered 2025 with typical seasonal patterns. However, looming tariff threats and evolving supply chain strategies are expected to create atypical season

At the TSMC Technology Symposium 2025 on May 15 in Hsinchu, Taiwan, T.S. Chang, VP of Advanced Technology and Mask Engineering at TSMC, announced the company's accelerated fab expansion plans. Pre

Chinese listed semiconductor equipment and materials companies released their 2024 annual financial reports in late April, revealing strong revenue growth but a decline in overall profitability. Despi

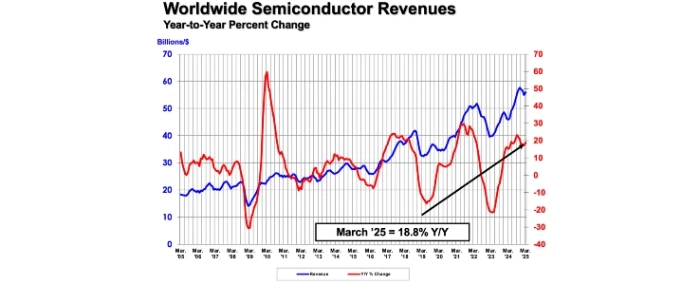

The Semiconductor Industry Association (SIA) reports that global semiconductor sales reached USD 167.7 billion in the first quarter of 2025, marking an 18.8% increase compared to the same period last